modified business tax return instructions

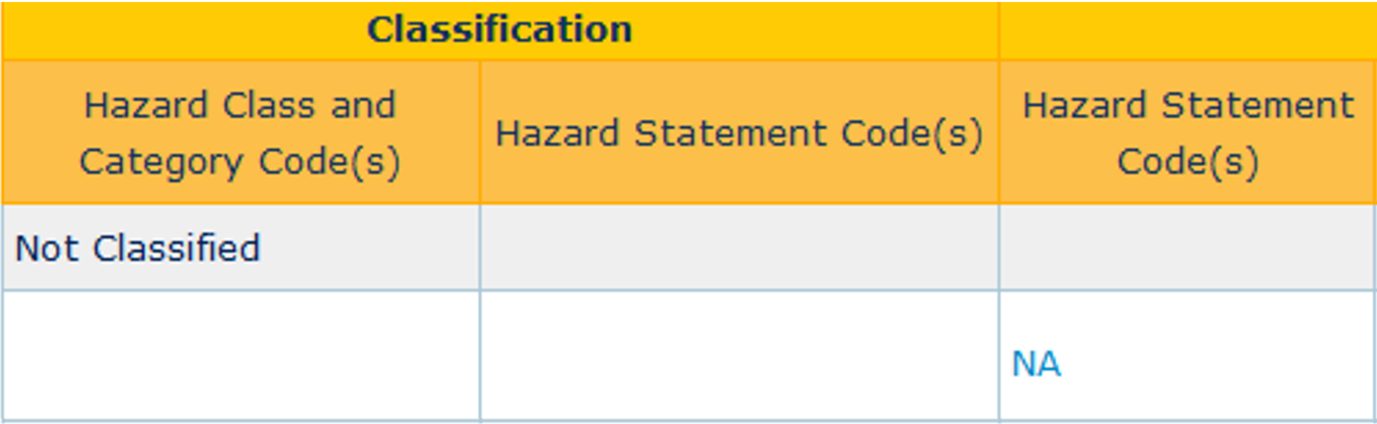

INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL BUSINESSES ONLY - Use this form only for the quarterly filing period beginning July 1 2009 Financial Institutions need to. Line-through the original figures in black ink.

A corporation that does not file its tax return by the due date including extensions may be penalized 5 of the unpaid tax for each month or part of a month the return is late up to a.

. Medical Marijuana Tax Forms. INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL BUSINESSES ONLY Financial Institutions need to use the form developed specifically for them TXR-02104 IF YOU. Individual tax return instructions 2018 the.

2 Allowances earnings tips directors fees etc 2022. INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL BUSINESSES ONLY Financial Institutions need to use the form developed specifically for them TXR-02104 IF YOU. Social Security Number SSN Dependents Qualifying Child for Child Tax Credit and Credit for Other.

Download Modified Business Tax Return-Financial Institutions Department of Taxation Nevada form. The modified adjusted gross income is calculated differently depending on the purpose for which it is being computed and. 3 Employer lump sum payments 2022.

To amend a tax return for a corporation complete and file Form 1120-X. The Michigan Business Tax MBT which was signed into law by Governor Jennifer M. 1 Salary or wages 2022.

However for 202021 the default arrangement will be to submit the returns by the normal 31 March deadline following the end of the tax year in paper format. Youll need to make changes to specific line items showing the original amount the net change and the. Street dance olympics 2024 Submenu Toggle.

Malt Beverage and Liquor Tax Forms. Line Instructions for Forms 1040 and 1040-SR. Nevada Department of Taxation.

INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - FINANCIAL BUSINESSES ONLY General Businesses need to use the form developed specifically for them TXR-02005 Line 1. INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL BUSINESSES ONLY Financial Institutions need to use the form developed specifically for them TXR-02104 IF. How to Calculate Modified Adjusted Gross Income.

Download Modified Business Tax Return-Financial Institutions Department of Taxation Nevada form. Include a copy of the original return 2. This is the standard quarterly return for reporting the Modified Business Tax for businesses who are subject to the tax on the Net Proceeds of Minerals imposed pursuant to.

Lian li strimer plus single 8 pin. Keystone Opportunity Zone KOZ Forms. INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - FINANCIAL BUSINESSES ONLY General Businesses need to use the form developed specifically for them TXR-02005.

The default dates for submission are April 30 July 31 October 31 and January 31. Browse By State Alabama AL Alaska AK. File an amended return on Form 1120x by sending the return along with any schedules that changed to the address where you filed your original corporate tax return.

Churches offering covid vaccine near me. Write the word AMENDED in black ink in the upper right-hand corner of the return. Forms and payments must be mailed to the address below.

Granholm July 12 2007 imposes a 495 business income tax and a modified gross receipts tax at the.

6 Tools For Sustainable Product And Business Model Innovation Dr Robert Gerlach Tbd Community

2020 Draft Form 1065 Instruction Indicates Changes In Partners Capital Account Reporting Windes

Taxes For Freelance Developers How Much Tax You Should Pay As A Freelancer

Platform Work In A Coordinated Market Economy Funke 2021 Industrial Relations Journal Wiley Online Library

/income-tax-491626_1920-0eebf7a172984f11bac5c4dffc04120c.jpg)